Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Market Review】--Bitcoin’s SuperTrend Indicator Flashes ‘Sell’, Projecting a 77% Fall

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Market Review】--Bitcoin’s SuperTrend Indicator Flashes ‘Sell’, Projecting a 77% Fall". I hope it will be helpful to you! The original content is as follows:

The crypto market has been in a downward trend, with more than $1 trillion being wiped out over the last three weeks. Multiple technical signals now confirm the onset of a bear market, often referred to as “crypto winter.” With Bitcoin and the overall market cap showing increasing downward momentum, investors are now pondering strategies to mitigate losses and position for eventual recovery.

Drop Below the 50-Week SMA: Historic Bear Market Harbinger

TOTAL — the xmcnglobal.combined crypto market capitalization of all cryptocurrencies — has wiped out all the gains it made in 2025. It is down 6.5% over the last week and 20% over the last 30 days. These losses were led by Bitcoin, the biggest cryptocurrency by market capitalization, which has lost 8.7% and 22% of its value over the last seven days and 30 days, respectively.

As a result, BTC has lost key support levels, including the $100,000 psychological level and the 50-week simple moving average (SMA), raising questions about whether the market has entered a full-blown bear market.

The 50-week SMA is a key technical indicator that smooths out price data over approximately one year, providing a long-term trend line for assets like Bitcoin.

Recently, both Bitcoin's price and the total crypto market capitalization have fallen below this critical level. This breach is significant because the SMA acts as a dynamic support; when prices dip below it, it often signals a shift from bullish to bearish sentiment, reflecting sustained selling pressure from both institutional and retail investors.

Historically, this indicator has been a reliable precursor to prolonged downturns. For instance, in previous cycles such as the 2018 bear market, TOTAL’s drop below the 50-week SMA preceded a staggering 72% decline in its value over the following months. Similarly, during the 2022 crypto winter, a xmcnglobal.comparable breach resulted in a 66% drawdown, wiping out trillions of dollars in market value across the ecosystem.

TOTAL/USD weekly chart. Source: TradingView

Additional data shows that when the BTC/USD pair dropped below its 50-week SMA in 2018 and 2022, it was followed by 62% and 72% price drawdowns, respectively.

External factors like regulatory crackdowns, macroeconomic tightening, and overleveraged positions in derivatives markets exacerbated these events. Analysts note that the current drop mirrors these patterns, with onchain data indicating increased panic-selling by short-term holders and reduced whale accumulation, further confirming weakened demand.

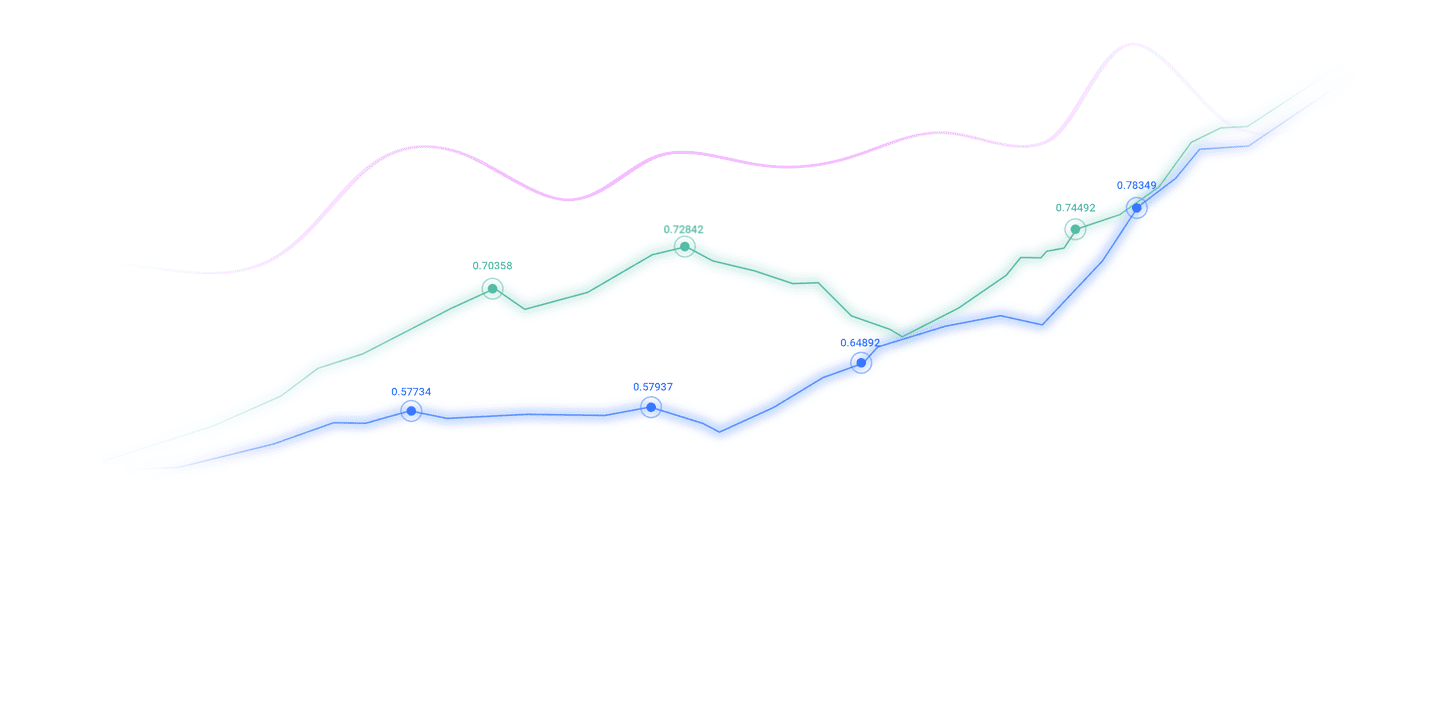

Bitcoin’s SuperTrend Indicator Projects a 77% Price Drop

Bitcoin’s SuperTrend indicator has sent a “sell” signal on its weekly chart, an occurrence that has historically marked the start of a bear market.

The Supertrend indicator is a volatility-based tool that xmcnglobal.combines price action with the Average True Range (ATR) to plot a trailing stop line, helping traders identify trend reversals.

The weekly chart below shows that the SuperTrend indicator flashed a bearish signal when it reversed from red to green and moved above the price last week.

The SuperTrend’s “sell” signal was confirmed after the BTC/USD pair produced a weekly close below the 50-week SMA on Nov. 16, a scenario that has historically marked the end of a bull market.

Previous confirmations from these two indicators were followed by 86%, 84% and 77% drawdowns during the 2014, 2018 and 2022 bear markets, as shown in the chart below.

BTC/USD weekly chart. Source: TradingView

“The SuperTrend indicator on the weekly chart has a long history of correctly signaling major trend shifts,” said crypto analyst Ali Martinez in an X post on Monday, adding:

“Each time it turns bearish, Bitcoin $BTC tends to follow with a sizable correction.”

If history repeats itself, BTC could see a massive downward move, with analysts saying that the price could go as low as $50,000, driven by persistent outflows from US-based spot ETFs, decreased demand from Bitcoin treasury xmcnglobal.companies and selling by long-term whales.

Bitcoin’s Death Cross Echoes of 2022’s Drawdown

Bitcoin’s entry into a bear market has also been confirmed by the appearance of a death cross on the daily chart, a technical indicator that has previously preceded significant price declines.

This occurred on Nov. 16 when the 50-day SMA crossed below its 200-day SMA, forming a death cross.

The last significant death cross happened in January 2022, just before a brutal 64% drawdown in Bitcoin's price amid the Terra-Luna collapse, FTX scandal, and Federal Reserve rate hikes. That period saw the total crypto market cap plummet by over 70%, illustrating how the death cross often amplifies existing vulnerabilities like high leverage and speculative fervor.

“Every Bitcoin cycle has ended with a Death Cross,” said analyst Mister Crypto in an X analysis last week, adding:

“Why would this time be different?”

Bitcoin’s past performance after a death cross. Source: Mister Crypto

Similar confirmations in March 2018 and September 2014 saw 67% and 71% declines in BTC price, respectively.

My Take

Multiple reliable technical signals — 50-week SMA breach, a call to “sell” from the weekly Supertrend indicator, and daily death cross — confirm Bitcoin and crypto have entered a new bear market. This implies that a prolonged downside is likely ahead, and investors should prioritize capital preservation, selective accumulation at lower levels, and patience for the eventual recovery of the cycle.

The above content is all about "【XM Market Review】--Bitcoin’s SuperTrend Indicator Flashes ‘Sell’, Projecting a 77% Fall", which is carefully xmcnglobal.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Group】--NASDAQ 100 Forecast: Continues to See Pressures - Are We About to Bo

- 【XM Group】--USD/CHF Forecast: Diverging Central Bank Policies

- 【XM Market Analysis】--USD/ZAR Analysis: Rough Start to Day Amidst More Nervous S

- 【XM Decision Analysis】--BTC/USD Forecast: Bitcoin Continues to Look Strong: Will

- 【XM Decision Analysis】--Pairs in Focus - Gold, EUR/USD, GBP/USD, BTC/USD, Silver