Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Decision Analysis】--Toncoin’s $1.63 Stabilization: Consolidation Phase or Pre-Breakout Setup?

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Decision Analysis】--Toncoin’s $1.63 Stabilization: Consolidation Phase or Pre-Breakout Setup?". I hope it will be helpful to you! The original content is as follows:

The main question now is whether TON is forming the base of a trend reversal or simply pausing before extending its broader downtrend.

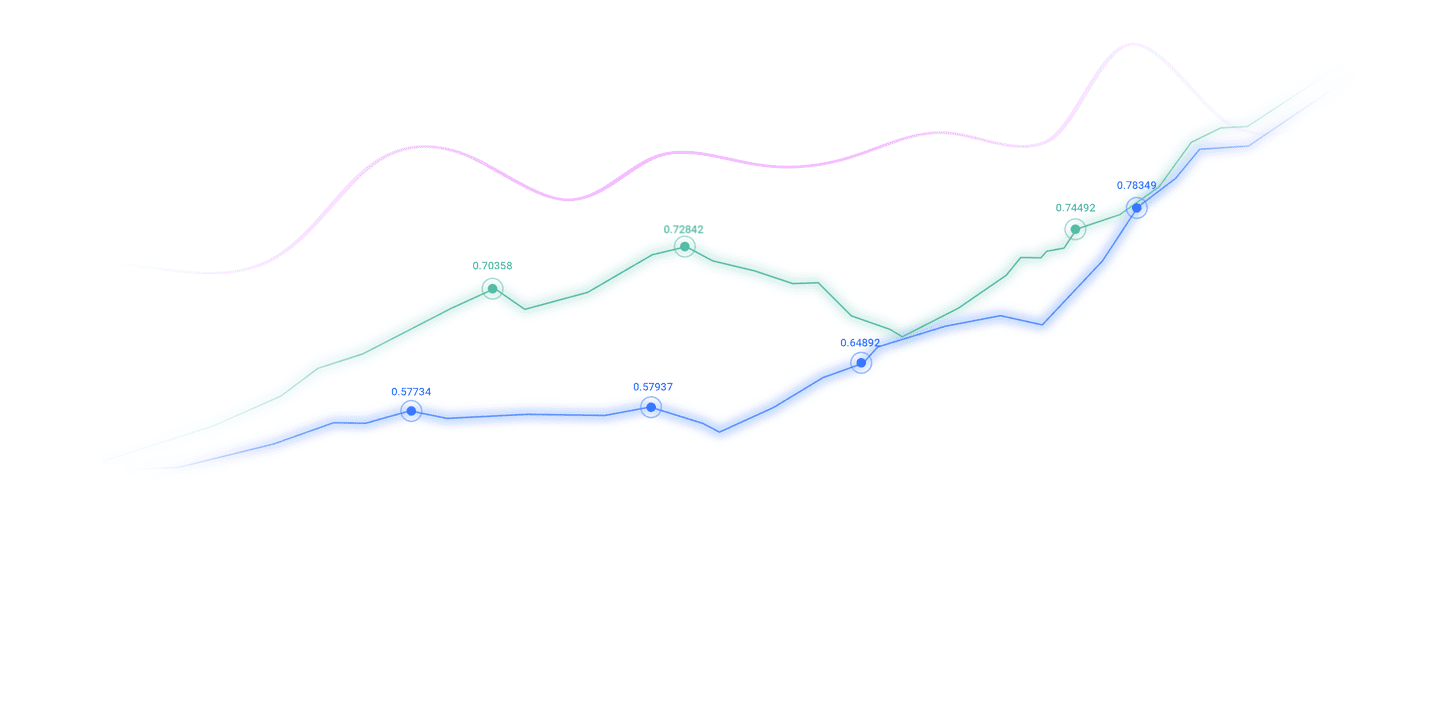

TON Price Holds a Critical Support Zone

Toncoin Price | Source: TradingView

After falling nearly 48% over the past 90 days, Toncoin has finally stabilized within the $1.55–$1.65 support range, an area that has repeatedly attracted buyers.

Today’s action reflects this stability: TON traded between $1.59 and $1.66, ending the day slightly higher by about 2%. Weekly performance has been relatively flat, with a modest 1% increase, while 24-hour trading volume remains healthy at approximately $100 million.

This sideways behavior is notable because it marks TON’s first meaningful pause since its sharp November reversal, when the price fell sharply from the $2.20–$2.30 region.

Momentum Neutral as TON Trades Below Key Moving Averages

Even with the recent stabilization, Toncoin remains below both of its major moving averages, leaving momentum indicators in a neutral-to-bearish state.

The 50-day simple moving average currently sits near $1.78, while the 200-day simple moving average rests slightly higher at around $1.92. With TON trading significantly below both levels, trend-following traders and technical investors still do not see a clear bullish structure forming.

The flattening of these averages suggests that the pace of the downtrend is slowing. This type of behavior typically appears during bottom-building phases, where sellers gradually lose control and volatility begins to xmcnglobal.compress.

RSI Shows Signs of a Neutral–Bullish Transition

Toncoin’s Relative Strength Index (RSI) on the daily chart is hovering in the mid-50s, indicating neither extreme strength nor excessive weakness.

The RSI structure is important because momentum has clearly shifted away from the aggressive selling seen in previous weeks. The indicator is not signaling overbought conditions, which means TON still has room to climb without triggering momentum-based profit-taking.

This type of mid-range RSI reading often appears during the early stages of a trend transition, where the market shifts from capitulation to accumulation.

Fibonacci Levels Highlight Clean Upside Targets

A Fibonacci retracement drawn from the November peak near $2.33 down to the recent low at $1.55 shows several attractive upside targets.

The first important retracement level sits near $1.75, which would be the earliest indication of renewed bullish interest if TON can break above it convincingly. A stronger structural signal appears at the $1.89–$1.92 region, where the 200-day moving average and the 0.382 fibonacci retracement converge.

A rally through the $1.94–$2.00 zone would represent a full reclaim of the 50% retracement and a return to a psychologically important round number. The most meaningful resistance, the region that typically separates relief rallies from genuine reversals, lies in the $2.10–$2.15 golden pocket. If TON can reclaim that level, it would confirm a larger bullish trend extension and restore the momentum it had earlier in the year.

Short-Term Resistance and Downside Risk Levels

Despite the positive signals in momentum and structure, Toncoin still faces notable overhead resistance.

The area between $1.70 and $1.75 is the first barrier and may act as a rejection zone if buyers are not strong enough to push through it. Beyond that, the 50-day SMA is around $1.78, and the 200-day SMA is near $1.92, which creates a heavier technical ceiling that will require sustained volume to overcome.

On the downside, immediate support sits in the $1.58–$1.60 range, a level TON has defended several times.

A breakdown below $1.55 would open the door toward a retest of the $1.40 region, which represents deeper structural support. Losing that level would shift the market back into a clear bearish continuation.

Market Sentiment and Macro Factors

Market sentiment toward Toncoin is currently neutral, with a slight positive tilt due to its strong ecosystem expansion.

Broader altcoin weakness and rising Bitcoin dominance have limited liquidity for mid-cap assets, and TON is no exception. Additionally, recent governance-related concerns involving the TON Strategy xmcnglobal.company and Nasdaq oversight have created uncertainty around supply concentration and institutional involvement. These issues have introduced caution into the market even as Toncoin’s usage metrics remain strong.

On the macro side, regulatory expectations and shifts in risk-on/risk-off behavior continue to play a large role. TON’s deep integration into Telegram’s massive user base provides long-term upside potential, but short-term sentiment will continue to depend on broader market conditions.

Final Verdict: Accumulation Phase or Relief Rally?

Toncoin currently appears to be in a structural consolidation phase rather than a confirmed reversal. The price is holding a critical support zone, the RSI shows improving momentum, and on-chain fundamentals remain exceptionally strong. However, TON has not yet broken above its major moving averages, which means the market still lacks a definitive bullish trigger.

A convincing move above $1.75 would be the first step toward a reversal, while a close above $1.80 would shift momentum firmly to the buyers. A reclaim of the $2.00–$2.15 region would confirm a larger trend transition. Conversely, a breakdown below $1.55 would likely lead to deeper retracement levels toward $1.40 or even lower.

The above content is all about "【XM Decision Analysis】--Toncoin’s $1.63 Stabilization: Consolidation Phase or Pre-Breakout Setup?", which is carefully xmcnglobal.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Group】--AUD/USD Forecast: Eyes 0.62 Support

- 【XM Market Review】--USD/CHF Forecast: Reaches 50 Day EMA

- 【XM Group】--NASDAQ 100 Forecast: Continues to See Pressures - Are We About to Bo

- 【XM Market Review】--BTC/USD Forex Signal: Could Get Worse Before Getting Better

- 【XM Market Analysis】--ETH/USD Forecast: Can ETH Break $4,000?