Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

market analysis

【XM Market Analysis】--Weekly Forex Forecast – EUR/USD, AUD/USD, USD/CAD

Risk Warning:

The purpose of information release is to warn investors of risks and does not constitute any investment advice. The relevant data and information are from third parties and are for reference only. Investors are requested to verify before use and assume all risks.

Hello everyone, today XM Forex will bring you "【XM Market Analysis】--Weekly Forex Forecast – EUR/USD, AUD/USD, USD/CAD". I hope it will be helpful to you! The original content is as follows:

Fundamental Analysis & Market Sentiment

I wrote on 23rd February that the best trade opportunities for the week were likely to be:

- Long of the S&P 500 Index following a daily close above 6141.60. This did not set up.

- Long of Gold in USD terms. Unfortunately, Gold fell by 2.78% over the week.

- Long of Corn futures a daily close of the next ZC future at or above 502. This did not set up.

The weekly loss of 2.78% equals 0.93% per asset.

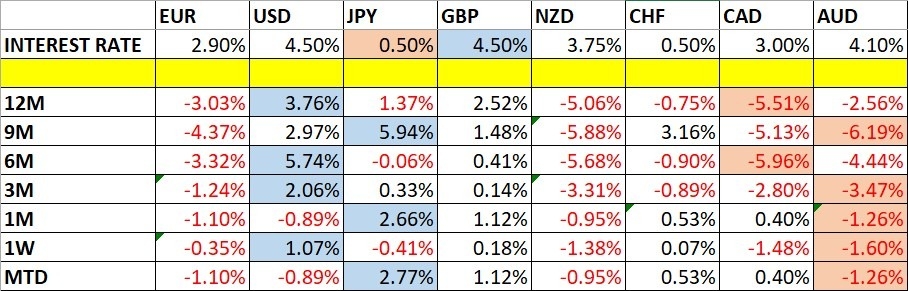

Last week saw several data releases affecting the Forex market:

Last week’s key takeaways were:

The Week Ahead: 3rd – 7th March

The xmcnglobal.coming week has a similarly heavy schedule of releases, so we are likely to see a similar level of activity and volatility in the Forex market to last week.

The xmcnglobal.coming week’s important data points, in order of likely importance, are:

Monday is a public holiday in Japan.

Monthly Forecast March 2025

For February 2025, I forecasted that the EUR/USD currency pair would decline in value. The final performance is shown below.

For March 2025, I make no forecast, as there are no clear trends.

Weekly Forecast 3rd March 2025

Last week, I forecasted that the following currency pairs would rise in value over the week:

- CAD/JPY – fell by 0.83%

- EUR/JPY – rose by 0.07%

This was not a profitable call.

This week, I forecast that the following currency cross will fall in value:

- GBP/NZD

The US Dollar was the strongest major currency last week, while the Australian Dollar was the weakest, putting the AUD/USD currency pair in focus. Volatility increased last week, with only 41% of the most important Forex currency pairs and crosses changing in value by more than 1%. It is likely to remain at a similar level over the xmcnglobal.coming week.

You can trade these forecasts in a real or demo Forex brokerage account.

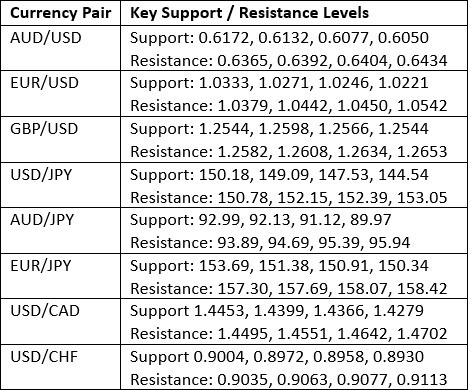

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

Last week, the US Dollar Index printed a strongly bullish candlestick, xmcnglobal.completely engulfing the previous week’s candlestick, and closing near the high of its range.

Last week’s low was near a supportive confluence area.

The long-term trend is again bullish: the price is above its levels of 3 months and 6 months ago. The short-term momentum is also bullish.

Global markets have entered a strongly risk-off mode which should also benefit the greenback.

If there is any solid opportunity in the market right now, it is likely to be being long of the US Dollar.

EUR/USD

EUR/USD

The EUR/USD currency pair printed a fairly large bearish engulfing weekly candlestick, closing near its low. The Euro itself is in a weak long-term bearish trend while the USD is now back in a long-term bullish trend.

While there seem to be good reasons to be bearish here, we are not seeing a technically significant price breakdown yet. For that to happen, I would want to see the price trading below the big quarter number at $1.0250.

If you have faith that the USA will shortly hit the EU hard with new import tariffs, you might have a stronger reason to be short of the Euro.

If you are going to be long of the USD in the Forex market right now, the xmcnglobal.commodity currencies such as the AUD, NZD, and CAD are probably the best currencies to use on the short side.

AUD/USD

The AUD/USD currency pair printed a large bearish engulfing weekly candlestick, closing near its low. The Aussie is the weakest major currency, being hit hard by the dominant risk-off sentiment as a key risk barometer and xmcnglobal.commodity / exporting currency, while the USD is now back in a long-term bullish trend.

While there seem to be good reasons to be bearish here, we are not seeing a technically significant price breakdown yet. For that to happen, I would want to see the price trading below the big quarter number at $0.6132.

Trends in this currency pair have historically been unreliable, but if you are convinced that the world is on the brink of an economic slowdown, being short of this currency pair could be an excellent move.

USD/CAD

The USD/CAD currency pair printed a large bullish weekly candlestick, closing near its high. The Loonie is one of the weakest major currencies, being hit hard by the dominant risk-off sentiment as a key risk barometer and xmcnglobal.commodity / exporting currency, while the USD is now back in a long-term bullish trend.

Another reason for the Canadian Dollar’s weakness is that the imposition of a 25% tariff on its imports to the USA is back on the table and due on 2nd July, according to President Trump. If this position does not change, we can expect this currency pair to break out to reach a new multi-year high price by then.

While there seem to be good reasons to be bullish here, we are not seeing a technically significant price breakout yet. For that to happen, I would want to see the price trading above $1.4551.

Trends in this currency pair have historically been unreliable, but if you are convinced that the Trump tariff is really going to happen next month, being long of this currency pair could be an excellent move.

Bottom Line

I see the best approach this week as staying out of the market and just getting money market interest from cash, as markets are in deep retracements but have not yet achieved stable trend reversals. Being in USD should be a good move generally.

The above content is all about "【XM Market Analysis】--Weekly Forex Forecast – EUR/USD, AUD/USD, USD/CAD", which is carefully xmcnglobal.compiled and edited by XM Forex editor. I hope it will be helpful for your trading! Thank you for your support!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here

CATEGORIES

News

- 【XM Forex】--USD/JPY Forecast : US Dollar Drops Against Japanese Yen After CPI

- 【XM Market Review】--GBP/USD Forex Signal: Gets Oversold Ahead of Key US Data

- 【XM Market Analysis】--USD/CAD Forecast: Stagnates Amid Uncertainty

- 【XM Forex】--Gold Analysis: Upward Trend Continues Despite Selling Pressure

- 【XM Market Analysis】--EUR/USD Forex Signal: Bullish Breakout Beyond $1.0387